IBC is actively working to offer insurance stakeholders information and tools to better understand condo insurance, the recent legislative amendment and settling divided co-ownership claims, so that they can, in turn, adequately inform consumers.

Settling divided co-ownership claims

See our microsite at co-ownership.bac-quebec.qc.ca to better understand this important process in co-ownership insurance.

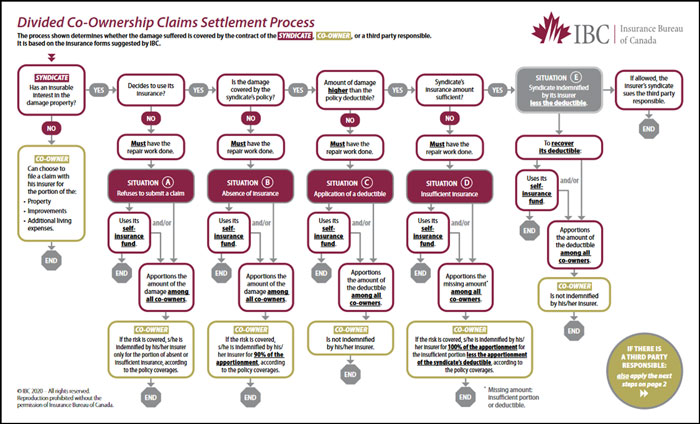

The process for settling divided co-ownership claims

The process shown below (also available in the Settling divided co-ownership claims microsite) determines whether the damage suffered is covered by the contract of the syndicate, co-owner, or a third party responsible. It is based on the insurance forms suggested by IBC.

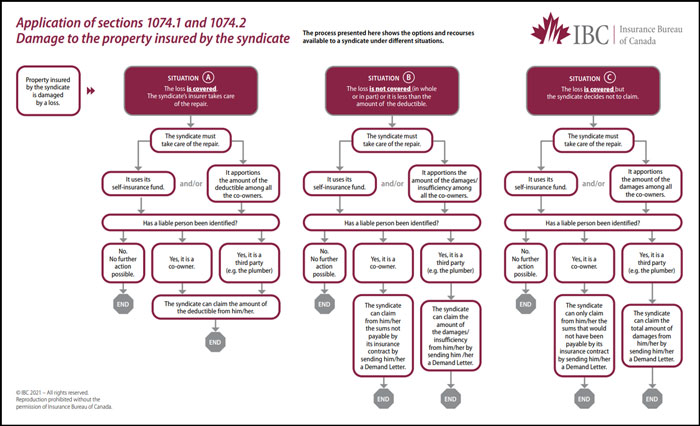

Decision tree for damage to the property insured by the syndicate

The process presented below (also available in the Settling divided co-ownership claims microsite) shows the options and recources available to a syndicate under different situations.

Inventory for establishing the description of a private portion

This guide offers co-ownership syndicates the possibility of establishing an inventory describing the private portions and differentiating improvements made by the co-owner.

Please note that this inventory tool is optimized to be used on a computer, and not on a tablet or smart phone.

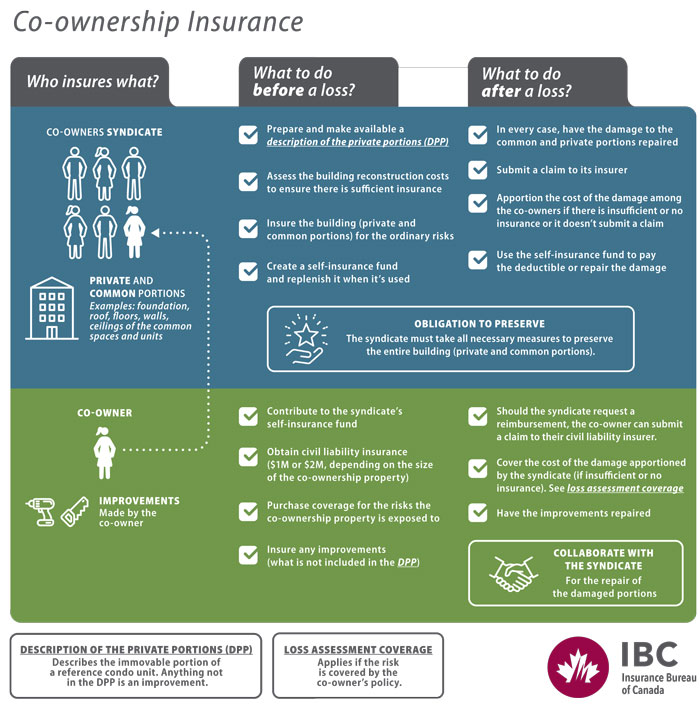

"Co-Ownsership Insurance" leaflet

Intended primarily for consumers, the " Co-Ownership Insurance" leaflet explains, visually and succinctly, the particularities that distinguish the insurance policy of the co-ownership syndicate and the co-owner's policy in terms of coverage and liability before and after a loss.

"Condo insurance" section of Infoinsurance

Intended primarily for consumers, the " Condo insurance " section of Infoinsurance contains several pages explaining the different facets of condo insurance.